Bussiness

Fintechzoom.com Economy: Insights, Trends, and Market Analysis

Introduction to the Fintechzoom.com Economy

The financial technology sector is advancing faster than ever before. As technology reshapes the way we handle finances, a unique ecosystem has emerged—the Fintechzoom.com economy. This dynamic sector combines cutting-edge innovations with financial services to create new opportunities for businesses and consumers alike. With its fingers on the pulse of modern finance, fintechzoom.com serves as a hub for insights, trends, and market analysis that shape our understanding of this rapidly changing industry.

From mobile payment solutions to blockchain advancements, the fintechzoom.com economy encompasses a broad range of technologies that are revolutionizing how we interact with money. In this blog post, we will explore key insights into what defines the fintechzoom.com economy today while examining its impact on various stakeholders—investors, entrepreneurs, and everyday users.

Join us as we delve into emerging trends and gather valuable perspectives that will paint a clearer picture of where this vibrant sector is headed next. Whether you’re an industry veteran or just getting started in your financial journey, there’s something here for everyone interested in understanding the forces driving change in finance.

What is Fintechzoom.com Economy?

The fintechzoom.com economy represents a dynamic intersection of finance and technology. It is a digital landscape where innovative solutions reshape traditional financial services.

At its core, this economy encompasses various sectors, including banking, payments, lending, and investment. Each segment leverages cutting-edge technologies to enhance efficiency and user experience.

Fintechzoom.com stands out by providing insights into this evolving market. The platform analyzes trends that drive change, offering valuable information for consumers and businesses alike.

Emerging technologies like blockchain and artificial intelligence are central to the fintechzoom.com economy. They enable faster transactions while increasing security measures—key factors in attracting users.

As more players enter the space, competition intensifies. This encourages constant innovation as companies strive to meet consumer demands in an ever-changing environment.

Key Insights and Trends in the Industry

The fintechzoom.com economy is evolving at an unprecedented pace. Digital payments have surged, reflecting a shift in consumer behavior and preferences. More people are opting for contactless transactions, highlighting the convenience of technology.

Artificial intelligence plays a pivotal role. It elevates client experiences by leveraging AI-driven chatbots and tailored financial guidance. This trend not only improves efficiency but also fosters trust between consumers and companies.

Blockchain technology continues to gain traction as well. Its potential to revolutionize security in transactions attracts significant attention from investors and startups alike.

Sustainability is another emerging focus within the industry. Fintech firms are increasingly promoting eco-friendly practices, appealing to environmentally conscious consumers.

Regulatory changes shape market dynamics too. Governments worldwide adapt their policies to accommodate innovative solutions while ensuring consumer protection remains paramount.

Impact of COVID-19 on the Fintechzoom.com Economy Industry

The COVID-19 pandemic has profoundly reshaped the fintechzoom.com economy. Traditional financial institutions faced unexpected challenges, while digital solutions gained unprecedented traction.

Consumers rapidly adopted online banking and contactless payments, pushing the industry to innovate at a breakneck pace. Fintech companies stepped in to fill gaps left by legacy systems, offering users seamless experiences.

Remote work also accelerated the need for digital finance tools. Startups flourished as they catered to changing consumer behaviors and needs during lockdowns.

Moreover, investment in fintech surged as venture capitalists recognized new opportunities amid uncertainties. Companies that were agile enough to pivot quickly reaped significant rewards.

As health concerns lingered, security became paramount; consumers demanded robust protection against fraud and data breaches. This heightened focus on cybersecurity forced firms within the fintechzoom.com economy to prioritize user safety more than ever before.

Market Analysis: Top Companies and Emerging Players

The fintechzoom.com economy is brimming with innovation and competition. Leading companies such as Stripe, Square, and PayPal have carved out significant market shares. Their advanced payment solutions cater to diverse businesses.

Emerging players are also making waves. Startups like Chime and Robinhood challenge traditional banking models with user-friendly platforms that attract younger consumers. They offer unique services that resonate in today’s digital-first landscape.

Established financial institutions are adapting too. Traditional banks are investing heavily in technology to enhance customer experiences, forming strategic partnerships with tech firms.

Geography plays a role as well; Asia-Pacific regions see fierce growth from local startups eager to capitalize on the unbanked population. The focus on blockchain technology continues to rise, enhancing transparency and security across transactions.

As these dynamics unfold, it’s clear that both established giants and nimble newcomers shape the evolving landscape of the fintechzoom.com economy.

Future Outlook for the Fintechzoom.com Economy

The future of the fintechzoom.com economy is poised for significant evolution. As technology continues to advance, new solutions will emerge, catering to an increasingly digital-savvy population.

Artificial intelligence and machine learning are set to revolutionize how financial services operate. Automation will streamline processes, making transactions faster and more secure.

Moreover, the rise of blockchain technology promises enhanced transparency and trust within financial systems. This could reshape traditional banking models entirely.

As consumer preferences shift towards personalized experiences, companies that leverage data analytics will have a competitive edge. Tailored offerings can foster stronger customer relationships.

Regulatory frameworks will evolve as well, shaping the landscape in which these innovations thrive. Stakeholders must stay agile to adapt to changing policies while pursuing growth opportunities in this dynamic market.

Challenges and Opportunities for Growth

The fintechzoom.com economy faces several challenges that could hinder its growth trajectory. Regulatory hurdles are a major concern. Compliance with evolving laws can create significant obstacles for startups and established firms alike.

Cybersecurity threats also pose a risk. As digital transactions increase, so do concerns about data breaches. Companies must invest heavily in security measures to protect sensitive information, which can strain resources.

Despite these challenges, opportunities abound in the fintechzoom.com economy. The shift towards digital banking has accelerated demand for innovative solutions, such as blockchain technology and artificial intelligence.

Consumer behavior is changing; people seek seamless experiences and personalized services. This creates space for companies willing to adapt quickly.

Moreover, emerging markets are ripe for investment. There’s untapped potential in regions that have traditionally lagged behind in financial technology adoption. With the right strategies, players can seize this opportunity to expand their reach effectively.

Conclusion: The Exciting Future of Fintechzoom.com Economy

The Fintechzoom.com economy is poised for an exciting journey ahead. As we navigate through the constant evolution of technology and consumer demands, this sector stands at a pivotal point. With innovations shaping financial services, businesses and consumers alike are benefitting from enhanced experiences.

Emerging technologies such as artificial intelligence and blockchain promise to streamline operations further, making finance more accessible than ever. The interest in sustainable investing is also gaining momentum, pushing companies to adapt their offerings to meet eco-conscious expectations.

As new players enter the market with fresh ideas and solutions, established firms will need to remain agile. This competitive landscape fosters innovation but also presents challenges that must be met head-on.

While uncertainties linger due to global economic fluctuations, the resilience shown by fintech companies indicates a strong potential for growth. Opportunities exist not just within traditional services but also in areas like digital currencies and decentralized finance.

The future holds great possibilities for the fintechzoom.com economy. With creativity driving change, stakeholders can look forward to redefining what financial interactions mean in our daily lives.

Bussiness

FSI Blogs US: How Financial Services Insights Can Boost Your Career

In today’s rapidly evolving financial landscape, staying informed is no longer optional—it’s essential. Entrepreneurs, tech innovators, and startup founders constantly seek actionable insights to guide their strategies and decision-making. Among the most valuable resources available are fsi blogs us, which offer nuanced perspectives on finance, technology, and market trends in the United States. These blogs serve as more than just news outlets they are platforms where ideas converge, innovations are discussed, and thought leadership is cultivated.

Understanding the relevance of fsi blogs us requires more than a cursory glance. They provide a window into the intersection of finance and technology, offering data-driven analysis, case studies, and commentary from industry experts. Whether you’re managing a growing startup, exploring fintech solutions, or assessing investment opportunities, these blogs can be the catalyst for smarter, more informed business decisions.

What Are FSI Blogs US?

The term “FSI” stands for Financial Services Industry, which encompasses banking, insurance, asset management, and fintech companies. FSI blogs US specifically cater to this sector, delivering insights relevant to the American market. These blogs often cover:

-

Regulatory updates and compliance trends

-

Innovations in financial technology (fintech)

-

Investment strategies and market forecasts

-

Case studies of successful startups and scaling strategies

-

Leadership and operational insights within the FSI sector

Unlike general news sites, FSI blogs US are curated for professionals seeking depth and practical relevance. They blend real-world experience with expert analysis, making them a vital resource for anyone operating in or around the financial services ecosystem.

Why Entrepreneurs Should Follow FSI Blogs US

For startup founders, staying ahead of the curve is critical. FSI blogs US offer a strategic advantage by:

-

Highlighting Emerging Trends: Understanding trends in fintech or regulatory shifts can help startups anticipate market needs before competitors.

-

Offering Expert Commentary: Many blogs feature interviews or insights from seasoned industry leaders.

-

Providing Case Studies: Detailed breakdowns of successful ventures can guide decision-making and operational improvements.

-

Connecting Communities: They often foster engagement among like-minded professionals, facilitating networking and collaboration.

Consider this: a founder exploring blockchain applications in banking might find actionable advice in a blog post detailing regulatory compliance requirements in the U.S. This kind of information is hard to obtain from general financial news sources.

Top Categories Covered by FSI Blogs US

FSI blogs US typically focus on specific areas of interest to professionals in the sector. Here’s an overview of key categories:

| Category | Focus Area | Why It Matters |

|---|---|---|

| Fintech Innovation | Blockchain, AI, payment solutions | Keeps startups ahead in technology adoption |

| Regulatory & Compliance | Federal regulations, state laws, SEC guidelines | Ensures business operations remain lawful and competitive |

| Market Insights | Investment trends, market forecasts | Guides strategic decision-making and portfolio management |

| Leadership & Strategy | Organizational growth, talent acquisition | Helps startups scale efficiently and sustainably |

| Customer Experience | UX/UI in finance, digital banking | Improves client retention and engagement |

This table demonstrates how fsi blogs us cover both technical and strategic topics, making them indispensable for decision-makers.

How FSI Blogs US Influence Business Decisions

FSI blogs US don’t just report on trends they shape them. By analyzing patterns in market behavior, sharing predictions, and offering expert interpretation, these blogs influence how businesses operate. For instance:

-

Investment Strategies: Blogs analyzing stock performance and fintech startups can influence venture capital decisions.

-

Product Development: Insights on consumer banking preferences may guide digital product launches.

-

Operational Efficiency: Articles on regulatory compliance and risk management help companies streamline internal processes.

The impact extends beyond immediate business decisions. Following these blogs regularly helps professionals build a knowledge base, identify opportunities, and anticipate challenges—turning reactive decision-making into proactive strategy.

Choosing the Right FSI Blogs US to Follow

Not all blogs are created equal. Entrepreneurs and tech professionals need to be selective. Here’s a guide for identifying the most valuable FSI blogs US:

-

Expertise & Authority: Look for blogs authored by recognized experts or industry veterans.

-

Relevance: Prioritize blogs covering topics pertinent to your sector or market.

-

Frequency & Quality: Regularly updated blogs with well-researched content offer more value.

-

Engagement & Community: Platforms that allow comments, discussions, or networking provide additional learning opportunities.

-

Analytical Depth: Choose blogs that go beyond surface-level reporting, offering actionable insights and practical recommendations.

By being selective, startup founders and professionals can maximize their return on time invested in reading these blogs.

Real-World Impact: Case Examples

Consider these scenarios where following fsi blogs us proved transformative:

-

Fintech Startup: A small payments company identified an emerging trend in AI-driven fraud detection by monitoring relevant blogs. Early adoption positioned them ahead of competitors, leading to significant investor interest.

-

Investment Firm: Analysts tracked blogs covering regulatory shifts affecting blockchain-based assets, allowing the firm to adjust their portfolios proactively, avoiding potential losses.

-

Traditional Bank: Leadership teams used insights from blogs about digital banking UX trends to revamp their mobile apps, improving customer engagement and retention rates.

These examples highlight how insights from blogs translate into tangible business outcomes.

Integrating Insights from FSI Blogs US Into Your Workflow

Reading blogs passively is not enough. To truly benefit:

-

Curate a Feed: Use RSS readers or professional platforms to consolidate blog updates in one place.

-

Take Notes: Extract key insights and categorize them based on strategy, operations, and technology.

-

Share & Discuss: Engage with your team or professional network to discuss implications and potential applications.

-

Experiment & Apply: Test insights in small, controlled ways before full-scale implementation.

-

Measure Impact: Track outcomes to refine which blogs provide the highest value over time.

This structured approach turns reading into actionable intelligence, giving startups a competitive edge.

The Future of FSI Blogs US

The role of fsi blogs us is only set to expand. With the continued convergence of finance and technology, blogs will increasingly cover areas like decentralized finance (DeFi), artificial intelligence in banking, and ESG-driven investments. Emerging trends like AI-powered wealth management tools and digital identity verification systems will likely dominate blog discussions, providing early insight into disruptive innovations.

Moreover, as the audience grows more sophisticated, blogs are expected to incorporate multimedia content, interactive dashboards, and data-driven visualizations to enhance understanding. For professionals who adapt early, staying engaged with these blogs offers a strategic advantage that traditional news outlets cannot match.

Conclusion

For startup founders, tech innovators, and finance professionals, fsi blogs us are not just optional reading—they are essential tools for informed decision-making. By offering in-depth analysis, expert perspectives, and actionable insights, these blogs empower professionals to anticipate trends, refine strategies, and seize opportunities. Integrating regular blog reading into your workflow, while selectively focusing on authoritative sources, can transform knowledge into measurable business success.

In a world where information moves faster than ever, staying connected to FSI blogs US ensures you are not only keeping pace but setting the pace.

Bussiness

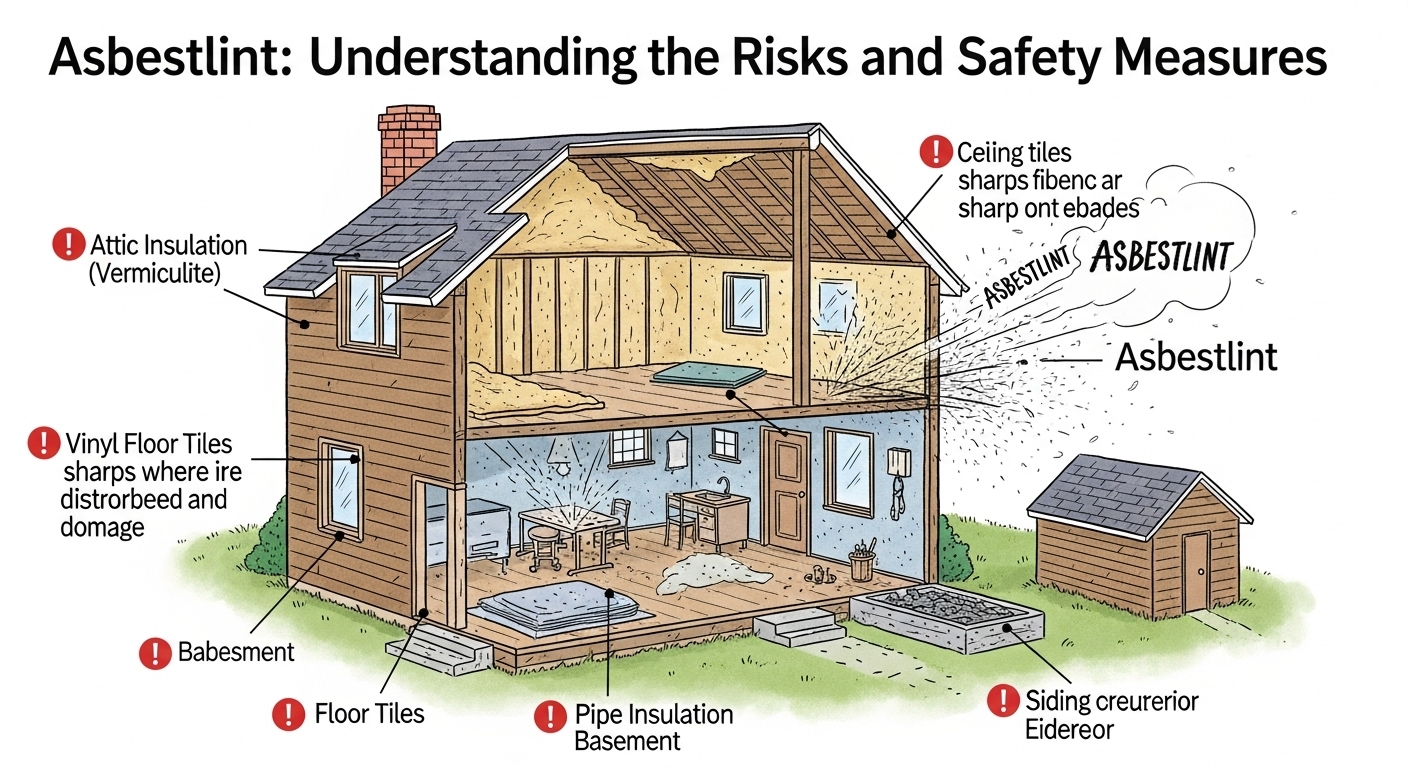

Asbestlint: Understanding the Risks and Safety Measures

In a world obsessed with cutting-edge AI, climate tech, and digital transformation, some of the most critical challenges businesses face are quietly hiding in plain sight. Asbestlint is one of those terms. It doesn’t trend on social media, and it won’t headline a tech conference keynote, yet it sits at the intersection of health risk, regulatory compliance, and operational responsibility. For founders, entrepreneurs, and tech professionals building long-lasting companies, understanding asbestlint is not optional—it’s strategic.

At its core, asbestlint refers to fine asbestos-related fibers and residues that remain in buildings, materials, or environments long after asbestos use has officially been banned or restricted. These remnants may be invisible to the naked eye, but their implications are very real. From legacy office spaces to industrial sites and aging infrastructure, asbestlint represents a hidden liability that modern organizations must address with clarity and foresight.

Understanding Asbestlint in Real-World Context

To grasp why asbestlint matters today, it helps to look backward. Asbestos was once celebrated as a miracle material. It was heat-resistant, durable, and inexpensive, making it a staple in construction and manufacturing throughout much of the twentieth century. When health risks became undeniable, regulations followed, and usage sharply declined. What didn’t disappear, however, were the millions of structures and products already containing asbestos-based materials.

As these materials age, degrade, or are disturbed through renovation, they can release microscopic fibers—what many professionals now broadly refer to as asbestlint. These particles linger in dust, insulation, air systems, and structural cavities. Unlike obvious hazards, asbestlint doesn’t announce itself. It accumulates quietly, often unnoticed until a compliance audit, renovation project, or health concern forces it into the open.

For startups leasing older buildings, manufacturers repurposing industrial spaces, or tech firms expanding into legacy infrastructure, asbestlint becomes an operational reality rather than a historical footnote.

Why Asbestlint Is a Business Issue, Not Just a Health Topic

It’s tempting to view asbestlint solely through a health and safety lens. While employee well-being is paramount, the business implications are equally significant. Regulatory penalties, project delays, legal exposure, and reputational damage can all stem from mishandling asbestos-related risks.

Entrepreneurs often pride themselves on speed and efficiency, but overlooking asbestlint can slow growth dramatically. A single discovery during construction or inspection can halt operations for weeks or months. For venture-backed startups or scaling companies, that kind of disruption can ripple through funding cycles, customer commitments, and long-term planning.

More importantly, modern stakeholders expect proactive responsibility. Investors, partners, and enterprise clients increasingly scrutinize environmental and safety practices. How a company manages legacy risks like asbestlint signals maturity, governance discipline, and long-term thinking.

The Role of Technology in Managing Asbestlint

This is where innovation quietly enters the picture. While asbestlint itself is a legacy issue, the tools used to manage it are increasingly modern. Digital inspection platforms, sensor-based air monitoring, compliance software, and data-driven risk assessments are transforming how organizations identify and respond to asbestos-related concerns.

Tech professionals are now applying familiar concepts—automation, analytics, and documentation workflows—to an old problem. Instead of relying solely on paper reports and manual audits, companies can track asbestlint-related risks across multiple sites in real time. This shift doesn’t just improve safety; it improves decision-making.

For example, predictive maintenance models can flag areas where aging materials are more likely to degrade, allowing teams to intervene before fibers are released. Cloud-based compliance dashboards help founders understand exposure levels and regulatory status without needing deep technical expertise.

Common Scenarios Where Asbestlint Appears

Asbestlint is rarely encountered in isolation. It typically emerges during moments of change. Office renovations, warehouse conversions, data center expansions, or infrastructure upgrades all increase the likelihood of disturbing old materials.

The table below highlights common environments where asbestlint may be present and why it often goes unnoticed:

| Environment Type | Why Asbestlint Is Common There | Typical Trigger Event |

|---|---|---|

| Older office buildings | Legacy insulation and ceiling materials | Remodeling or HVAC upgrades |

| Industrial facilities | Historic use of heat-resistant materials | Equipment replacement |

| Warehouses and logistics hubs | Aging roofing and wall panels | Structural repairs |

| Schools and institutions | Long building lifespans with limited renovations | Safety audits or expansions |

| Residential conversions | Commercial-to-residential redevelopment | Change of building use |

Recognizing these patterns allows leaders to plan ahead instead of reacting under pressure.

Asbestlint and Regulatory Expectations

Regulation around asbestos varies by region, but the underlying principle is consistent: ignorance is not a defense. Authorities expect organizations to identify, manage, and document asbestos-related risks responsibly. Asbestlint, even when unintentional, falls squarely within that expectation.

For startups and fast-growing firms, this can feel overwhelming. Many founders assume compliance is only relevant to heavy industry or construction. In reality, any company occupying physical space has a responsibility to understand its environment. The good news is that early awareness simplifies everything. Addressing asbestlint proactively is almost always less costly and less disruptive than responding after a problem emerges.

From a governance perspective, treating asbestlint as part of broader risk management aligns well with ESG initiatives and long-term compliance strategies.

Communicating About Asbestlint Without Creating Fear

One of the most delicate aspects of managing asbestlint is communication. Leaders must strike a balance between transparency and alarmism. Employees, tenants, and partners deserve honesty, but they also need context.

Clear explanations, professional assessments, and visible action build trust. When teams see that leadership understands the issue and is addressing it responsibly, confidence grows rather than erodes. This is especially important for tech-driven companies where talent retention and employer reputation matter deeply.

Experienced executives know that credibility is built not by avoiding difficult topics, but by handling them with competence and care.

Strategic Takeaways for Founders and Innovators

Asbestlint may sound like a niche or technical concern, but it carries broader lessons. It reminds us that innovation doesn’t exist in a vacuum. New ideas often operate within old structures, both literally and figuratively. Successful companies learn to navigate that reality instead of ignoring it.

Founders who integrate environmental and safety awareness into their growth plans position themselves for smoother scaling. Tech professionals who apply modern tools to legacy risks create tangible value. Entrepreneurs who treat compliance as strategy, not bureaucracy, earn long-term trust.

In this sense, asbestlint becomes a symbol of responsible innovation—proof that progress and precaution can coexist.

Conclusion: Why Asbestlint Deserves Your Attention

Asbestlint isn’t a buzzword, and it won’t drive clicks on its own. Yet for organizations building the future inside the infrastructure of the past, it matters deeply. It represents hidden risk, regulatory responsibility, and an opportunity to lead with foresight rather than reaction.

By understanding what asbestlint is, where it appears, and how modern tools can manage it, founders and professionals gain more than compliance. They gain resilience. In a business landscape where trust, safety, and sustainability increasingly define success, that resilience may be one of the most valuable assets a company can have.

Bussiness

CJMonsoon: How a Quiet Digital Force Is Shaping the Future of Smart Business

In a digital economy flooded with buzzwords and overnight trends, cjmonsoon stands out not by being loud, but by being deliberate. It represents a growing class of digital-first platforms that focus on intelligent systems, adaptive workflows, and long-term value creation rather than short-term hype. For startup founders, entrepreneurs, and tech professionals navigating constant disruption, cjmonsoon offers a compelling case study in how modern digital ecosystems are built, scaled, and trusted.

At its core, cjmonsoon reflects a shift in how businesses think about technology. Instead of treating tools as isolated solutions, it approaches digital infrastructure as a living system—one that evolves alongside users, data, and market demands. This philosophy is increasingly relevant as companies seek resilience, efficiency, and clarity in an environment defined by complexity.

Understanding the Concept Behind CJMonsoon

To understand cjmonsoon, it helps to step back and look at the broader context of digital transformation. Many organizations adopt new technologies reactively, layering software on top of outdated processes. The result is often fragmentation, rising costs, and operational confusion.

CJMonsoon takes a different approach. It emphasizes integration over accumulation. The idea is simple but powerful: technology should reduce friction, not introduce it. By aligning systems, data flows, and decision-making tools, cjmonsoon represents a model where digital infrastructure actively supports strategic goals.

This approach resonates strongly with founders and executives who have learned—often the hard way—that growth without structure leads to inefficiency. CJMonsoon’s relevance lies in how it reframes technology as an enabler of clarity rather than complexity.

CJMonsoon and the Rise of Intelligent Operations

One of the defining characteristics of cjmonsoon is its focus on intelligent operations. Modern businesses generate massive amounts of data, yet many struggle to translate that data into insight. Dashboards exist, reports are generated, but decisions still rely heavily on intuition.

CJMonsoon reflects a shift toward systems that do more than display information. It supports environments where data is contextualized, patterns are identified, and insights are surfaced at the right moment. This is particularly valuable for startups operating with lean teams, where every decision carries outsized impact.

Rather than replacing human judgment, cjmonsoon enhances it. By reducing noise and highlighting what matters most, it allows leaders to focus on strategy, creativity, and execution—areas where human input remains irreplaceable.

Why CJMonsoon Appeals to Startup Founders

Startup founders face a unique combination of uncertainty and urgency. They must move quickly, adapt constantly, and make high-stakes decisions with limited resources. In this context, cjmonsoon’s philosophy aligns closely with founder realities.

Instead of requiring heavy upfront investment or rigid structures, cjmonsoon-inspired systems are designed to scale gradually. They prioritize flexibility, allowing startups to evolve without repeatedly rebuilding their digital foundations. This is critical in early-stage environments where pivots are common and assumptions are frequently tested.

More importantly, cjmonsoon supports transparency. Founders gain clearer visibility into operations, performance, and customer behavior, reducing reliance on guesswork. That clarity often becomes a competitive advantage, especially in crowded markets.

CJMonsoon in the Broader Tech Ecosystem

CJMonsoon does not exist in isolation. It reflects broader shifts in the tech ecosystem toward modularity, interoperability, and user-centric design. As APIs, cloud-native platforms, and AI-driven tools become standard, the emphasis is no longer on whether technology is advanced, but whether it is aligned.

Tech professionals increasingly value systems that communicate seamlessly and adapt over time. CJMonsoon’s conceptual framework fits naturally into this environment, encouraging thoughtful architecture rather than rushed implementation.

The result is a digital ecosystem that feels cohesive instead of patched together. This means fewer bottlenecks. For product teams, it means faster iteration. For leadership, it means confidence that technology supports, rather than constrains, strategic ambition.

Practical Business Impact of CJMonsoon

The real strength of cjmonsoon lies in its practical impact. Businesses influenced by this approach often report improvements that go beyond metrics. Yes, efficiency increases and costs stabilize, but there is also a noticeable shift in organizational mindset.

Teams become more aligned because systems reflect shared priorities. Decision-making becomes faster because information is accessible and relevant. Customer experiences improve because backend complexity no longer leaks into frontend interactions.

The table below highlights how cjmonsoon-style digital thinking compares with more traditional approaches:

| Aspect | Traditional Digital Setup | CJMonsoon-Inspired Approach |

|---|---|---|

| System Design | Tool-based, fragmented | Integrated, ecosystem-driven |

| Data Usage | Retrospective reporting | Contextual, real-time insight |

| Scalability | Reactive and costly | Adaptive and intentional |

| Decision Support | Manual interpretation | Insight-driven assistance |

| Team Experience | Operational friction | Workflow clarity |

This contrast illustrates why cjmonsoon resonates with forward-thinking organizations. It is not about replacing everything overnight, but about evolving systems with intention.

CJMonsoon and Digital Trust

In an era of data breaches, algorithmic bias, and growing skepticism toward technology, trust has become a strategic asset. CJMonsoon’s emphasis on clarity and alignment contributes directly to digital trust.

When systems behave predictably, when data flows are transparent, and when outcomes can be explained, users—both internal and external—develop confidence. This trust extends to customers, partners, and investors, all of whom increasingly scrutinize how technology is used.

For entrepreneurs seeking funding or partnerships, demonstrating a cjmonsoon-style approach can signal maturity. It shows that the company is not just chasing growth, but building sustainable infrastructure capable of supporting it.

The Human Element in CJMonsoon

Despite its technological focus, cjmonsoon never loses sight of the human element. One of the most overlooked aspects of digital transformation is change fatigue. Teams are often overwhelmed by constant tool changes and shifting processes.

CJMonsoon’s philosophy counters this by emphasizing usability and continuity. Technology adapts to people, not the other way around. This reduces resistance, improves adoption, and fosters a culture where innovation feels empowering rather than exhausting.

For digital leaders, this human-centered approach is critical. It ensures that progress is inclusive and that technology serves as a bridge between strategy and execution.

Future Implications of CJMonsoon Thinking

Looking ahead, the principles behind cjmonsoon are likely to become more influential, not less. As AI systems grow more capable and automation becomes ubiquitous, the need for thoughtful orchestration will intensify.

Organizations that embrace cjmonsoon-style thinking will be better positioned to integrate emerging technologies without losing control. They will be able to experiment responsibly, scale confidently, and adapt continuously.

This is especially relevant for digital readers and tech professionals who are shaping the next generation of platforms. CJMonsoon offers a reminder that the future of technology is not just about what is possible, but about what is sustainable.

Conclusion: Why CJMonsoon Matters Now

CJMonsoon represents more than a digital concept; it reflects a mindset shift in how modern businesses approach technology. In a world where complexity is the default, it champions clarity. Where speed is celebrated, it values intention. And where growth is often pursued at any cost, it emphasizes alignment and trust.

For startup founders, entrepreneurs, and tech professionals, cjmonsoon offers a roadmap for building digital systems that last. It shows that innovation does not have to be chaotic and that progress can be both ambitious and thoughtful.

As the digital landscape continues to evolve, the quiet influence of cjmonsoon may prove to be one of its most enduring contributions.

-

Health3 weeks ago

Health3 weeks agoRunlia: Transform Your Athletics with the Leading Fitness App for Elite Performance in 2026

-

Fashion3 weeks ago

Fashion3 weeks agoMen’s Moss Cobaki Scrub Jacket | FIGS Performance Scrubs

-

Blog2 weeks ago

Blog2 weeks agoSosoactive: The Digital Culture Engine Powering Modern Brands and Startups

-

Social Media3 weeks ago

Social Media3 weeks agoDandork63: Unravel the Mystery of This Viral Online Enigma in 2026

-

Technology3 weeks ago

Technology3 weeks agoHentquz: Explore Fantasy Art and Digital Erotic Storytelling Innovations in 2026

-

Social Media3 weeks ago

Social Media3 weeks agoNinawelshlass1: Ninawelshlass1: Dive into Nina Salt’s Artistic World and Lifestyle Inspirations for 2026

-

Technology3 weeks ago

Technology3 weeks agoOLXKing123.com: Unlock Top Deals and Influencer Marketing Opportunities in 2026

-

Health3 weeks ago

Health3 weeks agoUniqueFit Scrubs Medical Apparel – Premium Comfort for Healthcare Professionals